Solo roth 401k calculator

Making contributions to your Solo 401k is a great way to grow your retirement nest egg. Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing.

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

Divide 72000 by 12 to find your monthly gross.

. Discover Which Retirement Options Align with Your Financial Needs. Solo 401 k Contribution Calculator. Roth vs Traditional Contribution Calculator.

A 401 k can be an effective retirement tool. Pay yourself a reasonable wage on a W2. As a self-employed individual we have 2 roles - the business owner and the worker the employer and the employee.

Self-employed 401 k Self-employed individuals owner-only businesses and partnerships can save more for retirement through a 401 k plan designed especially for you. For some investors this could prove. Official Site - Open A Merrill Edge Self-Directed Investing Account Today.

You only pay taxes on. If your business is an S-corp C-corp or LLC taxed as such. Ad Bank Account included with our 199 LLC formation.

Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation. Solo 401k Calculator For S Corp. Please note that this calculator is only intended for sole proprietors or LLCs taxed as such.

It provides you with two important advantages. Solo 401k Contribution Calculator 2020. Ad Make Educated Decisions About Your Retirement Plan.

Ad Search For Solo 401 K Plans Now. Ad Visit Fidelity for Retirement Planning Education and Tools. Official Site - Open A Merrill Edge Self-Directed Investing Account Today.

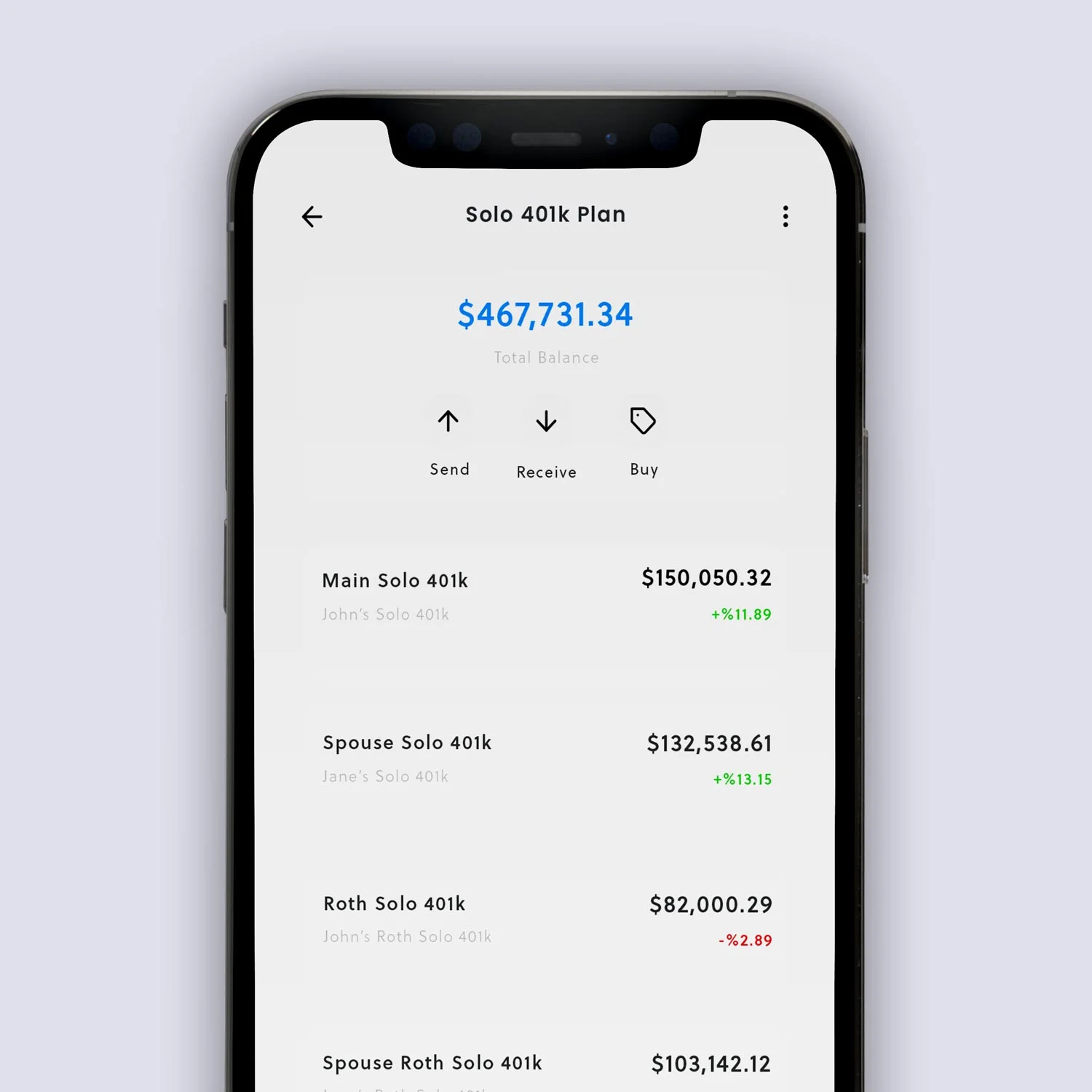

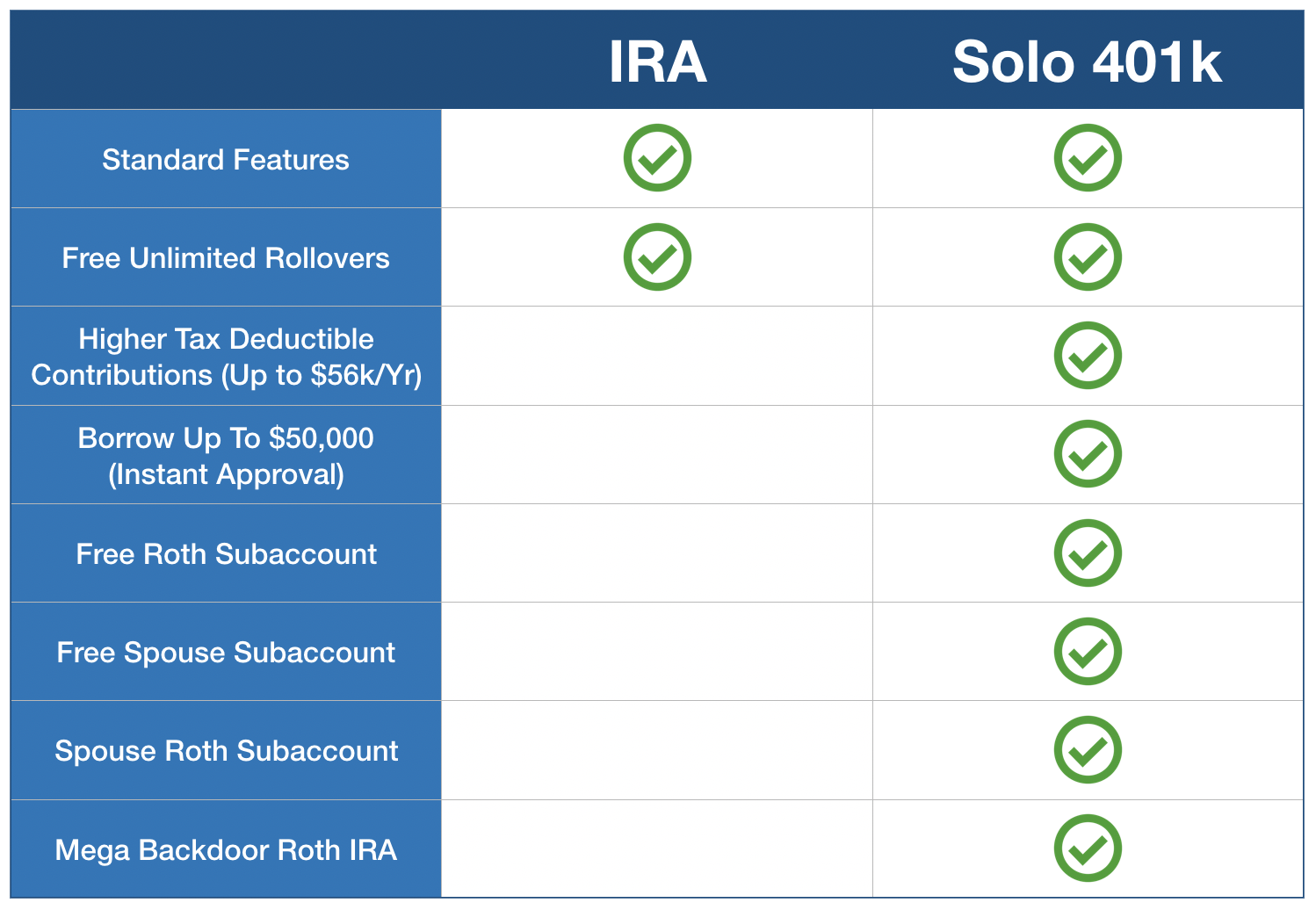

The Solo 401k by Nabers Group automatically includes both. Traditional 401 k and your Paycheck. A Roth solo 401k offers the same contribution limits as a Roth 401k with a normal employer.

The Roth 401 k allows contributions to a 401 k account on an after-tax basis -- with no taxes on qualifying distributions when the money is withdrawn. First all contributions and earnings to your 401 k are tax deferred. A 401 k can be one of your best tools for creating a secure retirement.

The major difference between Roth IRAs and traditional IRAs is. Contact a Financial Advisor. 401k calculator 401k and Roth contribution calculator.

The solo 401 k. For example say you are paid monthly your annual salary is 72000 and you elect to contribute 5 percent to your Roth 401 plan. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

Ad Open An Account That Fits Your Retirement Needs With Merrill Edge Self-Directed Investing. Find Solo 401 K Plans. Whatever Your Investing Goals Are We Have the Tools to Get You Started.

Roth 401 k contributions allow. 401k or Roth IRA calculator. Form your Wyoming LLC with simplicity privacy low fees asset protection.

In addition if the elective deferrals are for a Roth solo 401K Code AA must be used in Box 12 a Form W-2. Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings.

This calculator compares two alternatives with equal out of pocket costs to estimate the change in total net-worth at retirement if you convert your per-tax 401 k into an after-tax Roth 401. A Solo 401k can be one of the best tools for the self-employed to create a secure retirement. The Roth 401k is somewhat different from the traditional 401K as a retirement savings plan.

Solo 401 k Contribution Calculator. For 2022 this limit is 20500 and those 50 and over can make a 6500. S-Corp owners are required to pay a reasonable wage that is subject to employment tax.

In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. As of January 2006 there is a new type of 401 k contribution.

A Roth Solo 401k is similar to a traditional Solo 401k except for the difference between the tax-free and tax-deferred savings. For self-employment income earned through the S-Corporation the. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement.

You can contribute to both a Roth Solo 401k. A Roth IRA is a type of Individual Retirement Arrangement IRA that provides tax-free growth and tax-free income in retirement. It combines some features of the traditional 401k along with some features of the Roth IRA.

An IRA or individual retirement account is a tax-advantaged account that savers open on their own. First all contributions and earnings to your Solo 401k are tax-deferred.

Self Directed Ira Vs Solo 401k Which Is Best For Real Estate Investors Real Estate Investor 401k Investment Services

Solo 401k Contribution Calculator Solo 401k

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

Solo 401k Plans By Nabers Group Self Directed Retirement Experts

Solo 401k Contribution Limits And Types

Cisjnljn Dxwzm

Solo 401 K A Retirement Plan For The Self Employed Individual Rules Travel Credit Cards Small Business Credit Cards Travel Rewards Credit Cards

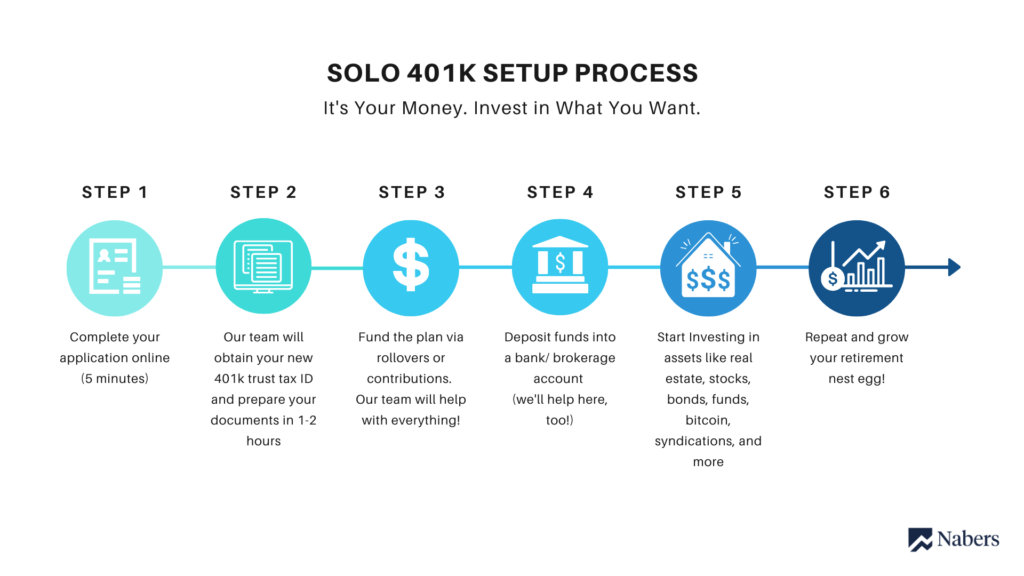

Solo 401k Setup Process Solo 401k

Solo 401k Contribution Calculator Solo 401k

Solo 401k Contribution For Partnership And Compensation

Open Your Solo 401k Solo401k Com

Making Year 2022 Annual Solo 401k Contributions Pretax Roth And Voluntary After Tax A K A Mega Backdoor My Solo 401k Financial

Solo Roth 401k Contribution Calculation For Small Business Owner Step By Step Full Walkthrough Youtube

The Solo 401k The Entrepreneur S Guide To A Powerful Pension Plan How To Plan Types Of Planning 401k

Solo 401k My Solo 401k Financial

How To Calculate Solo 401k Contributions Self Employed Retirement Plan Youtube

Solo 401k Contribution Limits And Types