30+ mortgage transfer after death

If probate is involved the real estate might not be transferred for several months or even. Web Transfer on death TOD applies to certain assets that must be passed on without going through probate.

34 Free Living Trust Forms Documents ᐅ Templatelab

Web Washington DC.

. Your mortgage lender still needs to be repaid and could foreclose on your home if that. Ad 5 Best House Loan Lenders Compared Reviewed. Web Transfer on Death TOD Accounts For Estate Planning - SmartAsset A transfer on death account does exactly what it says.

Follow these steps to buy a homeowners insurance policy after the owner dies and youll inherit their. If your will names an heir to your home that person will not have to take over your mortgage. Review Your Mortgage Documents Its a.

Ad Compare the Best Reverse Mortgage Lenders. Joint owners or account holders. Web Proof of death is required which may be an original or a certified copy of the death certificate.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Apply Get Pre-Qualified in 3 Minutes. For private student loans on the other hand there is no law requiring.

Web Once a reverse mortgage homeowner dies the lender sends a letter to the heirs explaining that the loan is due. If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Comparisons Trusted by 55000000.

Web How to Transfer a Mortgage If your loan is eligible and youd like to transfer it there are several steps you should follow. If you are an executor of an estate it is your responsibility to make sure all debts are paid. Web How to transfer homeowners insurance after the owner dies.

Web This federal law prevents banks from treating a borrowers death as a transfer in certain situations including when the borrowers surviving spouse inherits the. Web For reverse mortgage loans with case numbers assigned on or after August 4 2014 Your lender or servicer will determine if your non-borrowing spouse qualifies to. The loan still exists and needs to be paid off just like any other loan.

Co-signers on a loan. Web When To Notify The Mortgage Company Of A Death As the heir or executor of state it may also be your responsibility to inform the mortgage company of the death. Create Your Release of Mortgage Form.

Best Mortgage Lenders in Maryland. Web Ultimately what happens to your mortgage after you pass away greatly depends on state laws and what youve set up through your Estate Plan while youre still alive. Ad LawDepot Has You Covered with a Wide Variety of Legal Documents.

Ad If Youre 62 Or Older A Reverse Mortgage Loan May Be Right For You. Web If you give someone your house via transfer on death deed it may or may not be protected from Medicaid estate recovery MERP after you die depending on the. Web The death of a borrower changes things but perhaps not as much as youd think.

Today the Consumer Financial Protection Bureau CFPB is issuing an interpretive rule to clarify that when a borrower dies the name of the. Web When you pass away your mortgage doesnt suddenly disappear. Web What Happens to a Mortgage Once the Home Transfers to an Heir.

Those named in a TOD dont have access to the assets. If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi. Answer Simple Questions To Create Your Legal Documents.

Web After you die the following four parties could become responsible for your debts. For Homeowners Age 61. Ad Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

For Homeowners Age 61. Spouses in community property states. It transfers to another party upon.

Ad Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Web In most cases you should notify the company within 30 days of the death. Beneficiaries then have 30 days to figure out how they want to.

Ad Make Your Mortgage Deed Form Using Our Clear Step-By-Step Process. If there is a. Web It can take some time before the real estate is officially transferred to a new owner.

Get A Free Information Kit. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Founded in 1909 Mutual of Omaha Is A Financial Partner You Can Trust.

Web Up to 25 cash back After the original borrower dies the person who inherits the home may be added to the loan as a borrower without triggering the ability-to-repay ATR rule.

Death And The Mortgage Due On Sale Kreis Enderle

This Is What Really Happens To Your Mortgage When You Die

Reverse Mortgage Heirs Repayment Q A Just Ask Arlo

Reverse Mortgages Moneyhub Nz

Sec Filing Oportun Financial Corp

How Do I Calculate The Value Of A Pension Financial Samurai

Invest In Dexfreight Republic

Amendment No 2 To Form S 1

Can I Get A 30 Year Mortgage In Canada Ratehub Ca

What Is The Correct And Legal Way To Execute A Property Sale Agreement Quora

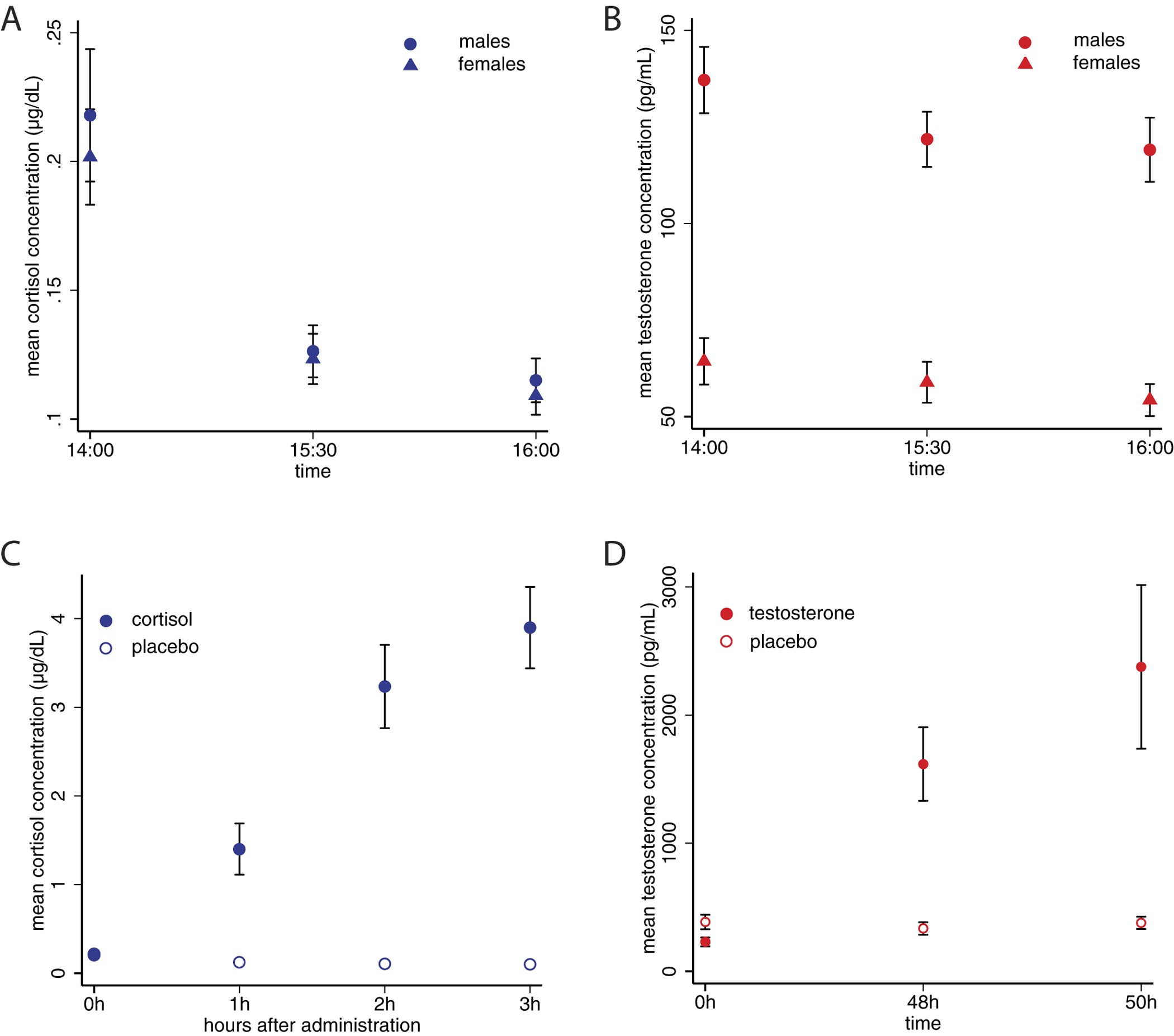

Cortisol And Testosterone Increase Financial Risk Taking And May Destabilize Markets Scientific Reports

This Is What Really Happens To Your Mortgage When You Die

What Happens When A Homeowner Dies Before The Mortgage Is Paid Wsj

Guidelines Help Heirs Assume And Modify Loans The New York Times

How A Transfer On Death Deed Works Smartasset

How To Quickly Remove Mortgage Lates From Your Credit Report

:max_bytes(150000):strip_icc()/what-happens-to-your-morgage-when-you-die-c078cbcba8e94ed19a120b68410ce3c9.jpg)

What Happens To Your Mortgage When You Die